After months of anticipation and countless negotiations, Congress finally passed the Tax Cuts and Jobs Act at the end of 2017. Hailed as the most significant change to the U.S. tax code in more than 30 years, Republicans hope that the new legislation will boost the economy by spurring job growth, driving wages higher, and increasing corporate investment in the country.

The legislation will significantly boost capital investments in the middle market and increase deal flow across the United States. One of the most anticipated changes of the act included a reduction in the corporate tax rate from 35 percent to a flat 21 percent and the repeal of the corporate alternative minimum tax. Both changes became effective after Dec. 31, 2017 and will increase the after-tax profitability of corporations.

Both strategic and private equity buyers are expected to see benefits from tax reductions. For private equity firms, this may mean on a higher return on their investments. Strategic buyers will invest more in their U.S. operations, including making acquisitons.

The new tax bill is expected to have a positive impact on a number of sectors including: infrastructure, manufacturing, consumer, and pharmaceuticals.

"I think there is a lot of enthusiasm in the middle market," says Nixon Peabody partner Richard Langan Jr. "There will be great investments by some companies including on infrastructure. It will cause them to make some M&A decisions particularly on the buyside. This may also cause some family funds to consider M&A as opposed to interfamily transfers."

Strategic investments

Some corporations, such as AT&T Inc. (NYSE: T), are using these extra savings as compensation incentives for employees. Corporations will also be looking for making additional investments in the business which sets the stage for M&A activity, says Keiter's Gary Wallace.

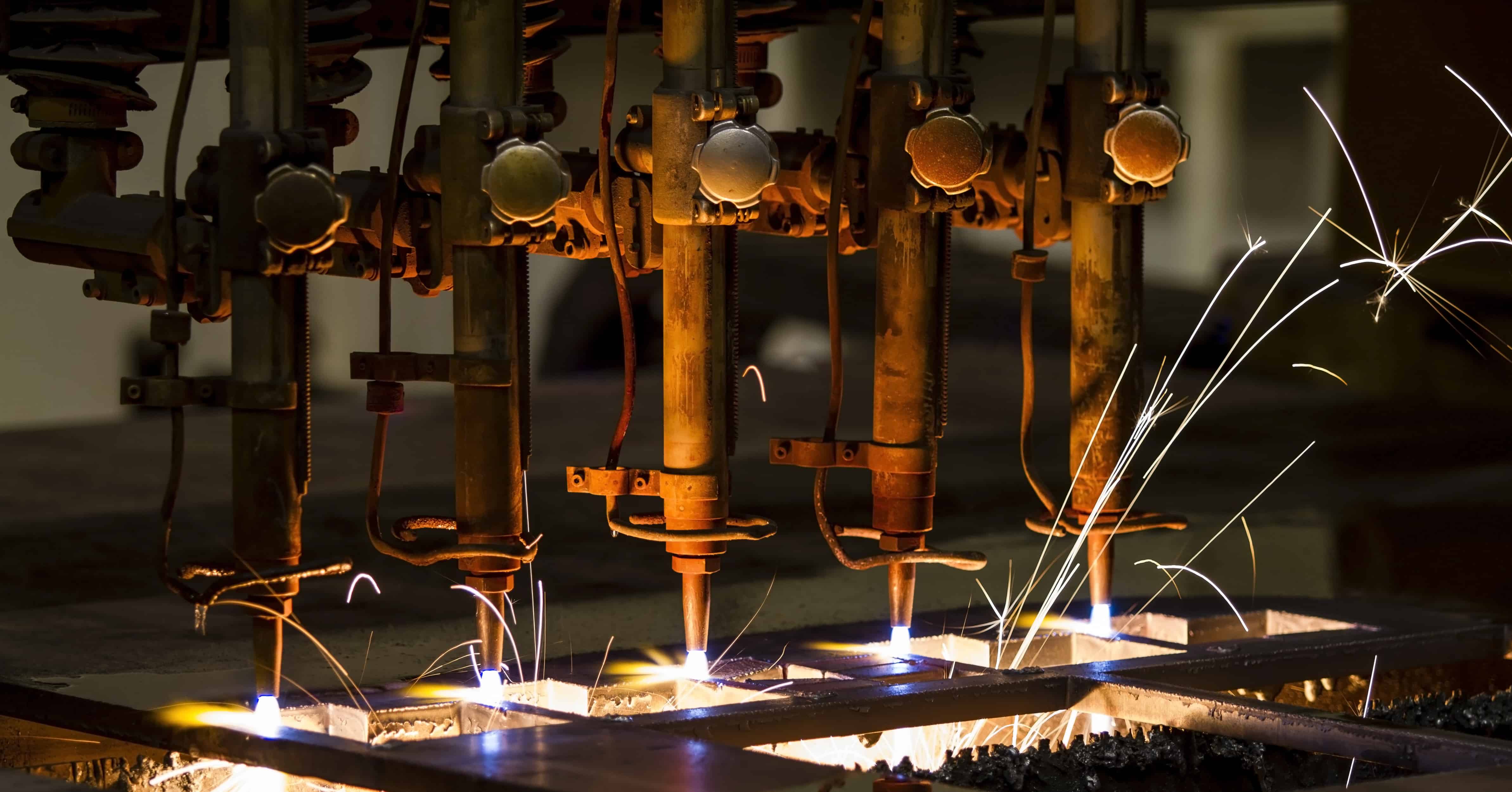

Manufacturing benefits

Manufacturing companies will see some immediate write-offs and an increase in their enterprise values, according to Nixon Peabody's Richard Langan Jr.

Banks to get a boost

M&A is one way banks and financial institutions could reinvest in their businesses, according to dealmakers.

Family funds to consider M&A

Family funds to consider M&A as opposed to interfamily transfers, Langan points out. For example, Watermill sold wire and cable distributor C&M Corp. to Snow Phipps.