Private equity firm TPG is buying credit shop Angelo Gordon for $2.7 billion, gaining a foothold to muscle into the business of lending as banks retreat from making loans.

TPG said that the purchase of New York-based Angelo Gordon will create an investment manager running a collective $208 billion. TPG will gain a $55 billion billion credit business to compete against rivals, such as Blackstone Inc. and Apollo Global Management, which are now major providers of financing to corporations.

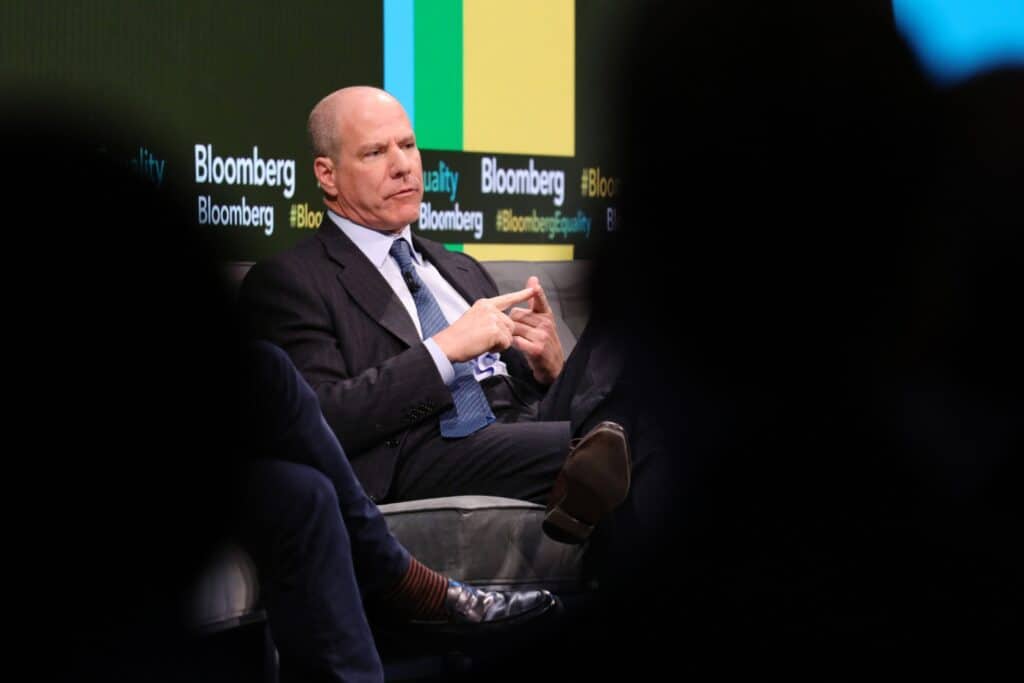

“This transaction offers multiple ways to accelerate growth,” CEO Jon Winkelried told investors Monday. Nonbank lenders have become bigger players on Wall Street over the years, he said on the call.

Now, TPG is poised to jump into the business of lending as banks get hit by rising interest rates and regulatory burdens.

TPG, based in Fort Worth, Texas and San Francisco, has been looking for a credit business since 2020, when TPG’s debt business, Sixth Street Partners, split from the firm.

The private equity shop shaped by David Bonderman and Jim Coulter went public last year, and Winkelried faces the task of expanding TPG beyond its buyout roots and showing shareholders it can deliver steady fee streams in all markets.

Pressure to Diversify

A dealmaking slump and diminishing appetite by pensions and endowments to back mega-buyout funds heightens the pressure on TPG to diversify its business. TPG said on its investor call that it expected its flagship funds to collectively be smaller than it initially projected.

The acquisition of Angelo Gordon will grow-fee related earnings over time, executives said. TPG also gains Angelo Gordon’s $18 billion real estate business, enabling the firm to snap up properties as rising interest rates and a slowing economy depress valuations.

Angelo Gordon, founded in 1988, made its name on Wall Street as a hard-knuckled investor that could swoop in on distressed companies and shape bankruptcies. It has also grown in the business of direct lending and structured credit.

TPG will pay an estimated $970 million in cash and up to 62.5 million common units of the TPG operating group and restricted stock units of TPG. The purchase is expected to close in the fourth quarter, and Angelo Gordon will become a platform within TPG.

That business will be run by Angelo Gordon’s current co-CEOs, Josh Baumgarten and Adam Schwartz, who will report to CEO Winkelried.