The biggest bank merger in more than a decade overshadowed a slowdown in M&A activity in February.

BB&T in Winston-Salem, N.C., and SunTrust Banks in Atlanta shocked the industry when they announced a merger agreement valued at $28 billion.

It immediately fueled speculation that other large deals could be on the horizon. Such questions had already begun last month when Chemical Financial in Detroit and TCF Financial in Wayzata, Minn., announced a merger agreement to form a $45 billion-asset bank.

That excitement aside, just nine bank deals were announced last month, down from 17 in January. Overall activity in the first two months was off more than 25% from a year earlier, based on data compiled by FIG Partners.

Still, there were some other notable deals announced in February. Another credit union agreed to buy a bank, and a few serial acquirers continued their quests for scale. Here are five takeaways from the month’s M&A activity.

Megamerger

BB&T and SunTrust finally announced the merger deal that had been speculated about for years.

The agreement, announced on Feb. 7, would create a $442 billion-asset bank that spans 17 states. BB&T would own 57% of the new company, which would have $301 billion in loans, $324 billion in deposits and 10 million U.S. households as customers.

Executives plan to rebrand the combined bank and move its headquarters to Charlotte, N.C., though there is no word yet on the new name or logo. They said during a conference call with analysts that they would seek employee input on the new brand.

The transaction creates lots of possibilities for rivals, especially smaller ones. Community bank executives could have the opportunity to pick up branches, deposits and displaced employees if regulators approve the deal.

It also has bank watchers guessing which regional banks will be next to announce deals.

A credit union strikes again

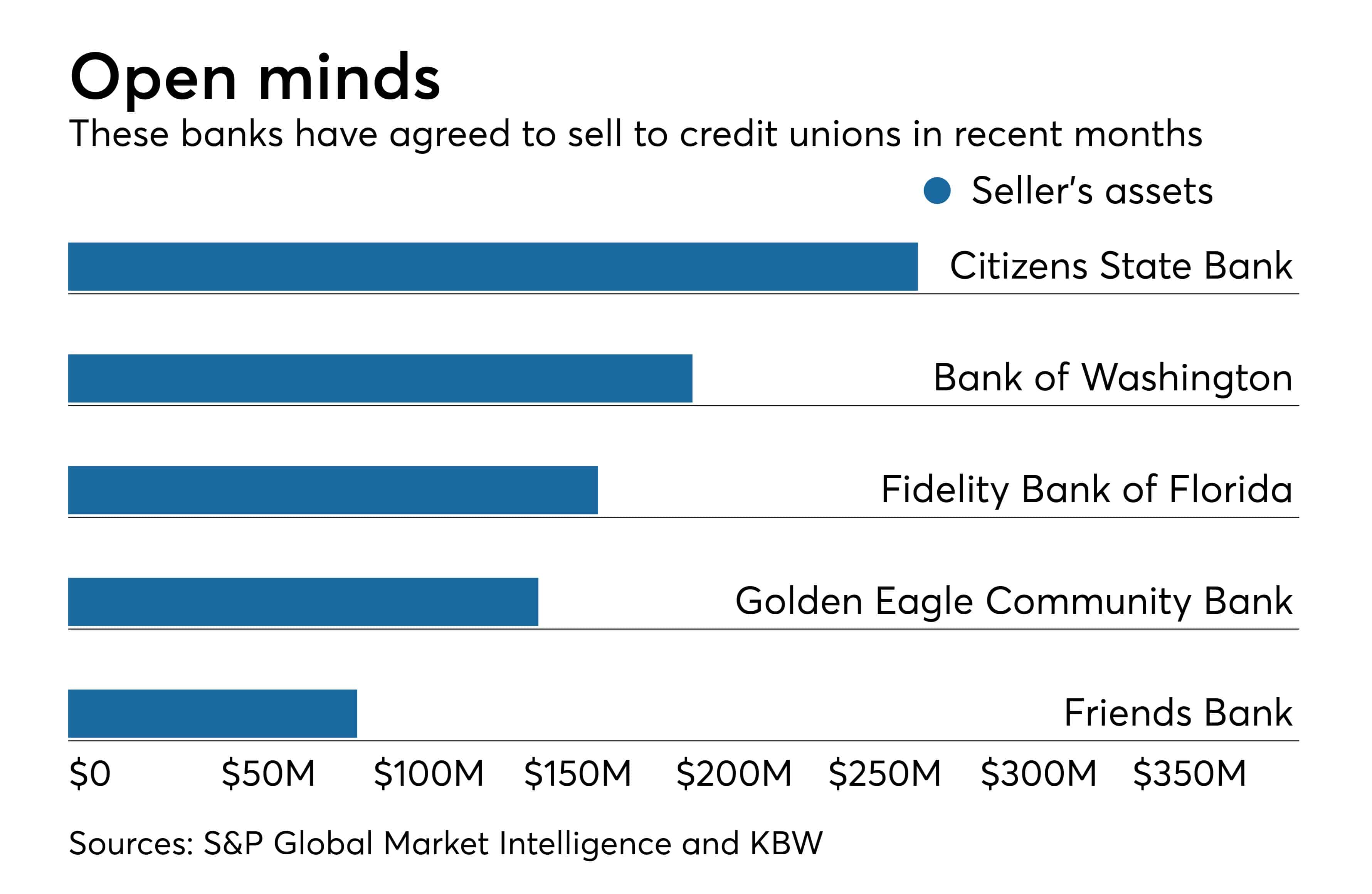

Another credit union has agreed to buy a Florida bank.

This time, the $2.2 billion-asset Fairwinds Credit Union in Orlando said it would acquire the $95 million-asset Friends Bank in New Smyrna Beach. The credit union did not disclose the price.

Fairwinds has 30 branches and 183,000 members, while Friends has three branches.

Florida has been fertile ground for credit unions seeking banks to buy. VyStar Credit Union's agreed to buy Citizens State Bank in Perry, and Central Florida Educators Federal Credit Union said it will acquire Fidelity Bank of Florida in Merritt Island.

Industry observers expect these types of deals to pick up in 2019 as credit unions look for ways to expand.

Back in gear

A pair of serial acquirers revealed their latest targets.

Wintrust Financial in Rosemont, Ill., agreed on Feb. 20 to buy Rush-Oak in Chicago. A week later, Hometown Financial Group in Easthampton, Mass., agreed to buy Millbury Savings Bank in Massachusetts.

Hometown did not disclose the price of its deal, which expands the bank’s operations into the Worcester and Millbury markets in Massachusetts. The transaction would add "a team of talented bankers,” Matthew Sosik, Hometown’s president and CEO, said in the press release announcing the deal.

Hometown, which completed its $54 million acquisition of Pilgrim Bancshares on Jan. 31, also has a pending deal for Abington Bank that is expected to close in the second quarter.

The $31 billion-asset Wintrust agreed to pay $46 million in cash for the parent of the $196 million-asset Oak Bank. The deal, which should be completed in the second quarter, allows the bank to “expand our market presence in the heart of” Chicago, Ed Wehmer, Wintrust’s president and CEO (pictured), said in the company's press release.

The deal follows Wintrust’s purchase of Delaware Place Bank in Chicago in August.

Rural play

Stone Bancshares in Mountain View, Ark., announced on Feb. 25 that it was acquiring DBT Financial and its DeWitt Bank and Trust unit in Arkansas.

The acquisition would give the $372 million-asset Stone two more branches in rural communities. Stone did not say how much it will pay.

“We are very excited to extend our banking brand and services into Arkansas County,” Marnie Oldner, Stone Bank's CEO, said in a press release announcing the deal, which is expected to close in the second quarter.

DeWitt Bank "is a good fit with our suite of services designed for rural communities and the expertise we’ve developed in farm lending," Oldner added. "This merger will also allow Stone Bank to begin offering trust services, which are so important in farming communities. We pride ourselves on customer service and community involvement including both high-touch and high-tech solutions for our customers.”

David Jessup, DeWitt's president and CEO, said in the release that DBT’s customers will benefit from “broader access to the capital they need from a well-run community bank with plans to continue our commitment to the farmers, businesses and families of South Arkansas.”

Kentucky expansion

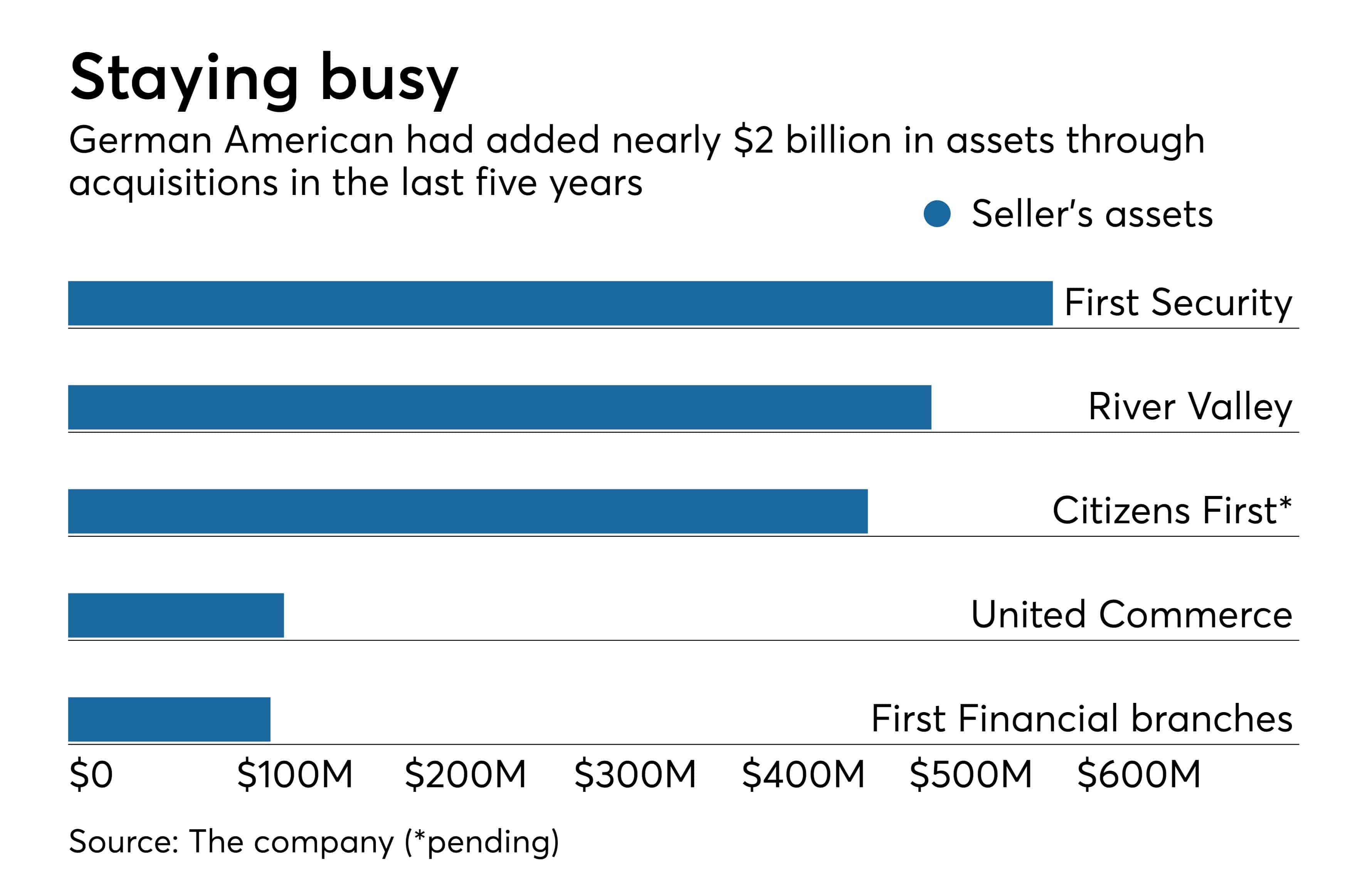

German American Bancorp in Jasper, Ind., is buying Citizens First in Bowling Green, Ky.

The $3.9 billion-asset German American agreed on Feb. 22 to pay $68.2 million in cash and stock for the $476 million-asset Citizens First. The deal is expected to close in the third quarter.

It furthers German American’s expansion into “vibrant Kentucky markets and strengthens our local presence in the Bowling Green market area, which has demonstrated a history of dynamic growth and prosperity,” Mark Schroeder, the company’s chairman and CEO, said in a press release announcing the deal.

Todd Kanipe, Citizens First’s president and CEO, will become a regional president at German American. One Citizens First director will join German American’s board.

Citizens First has $372 million in loans and $389 million in deposits.

German American completed its $101 million purchase of First Security in Owensboro, Ky., in October.