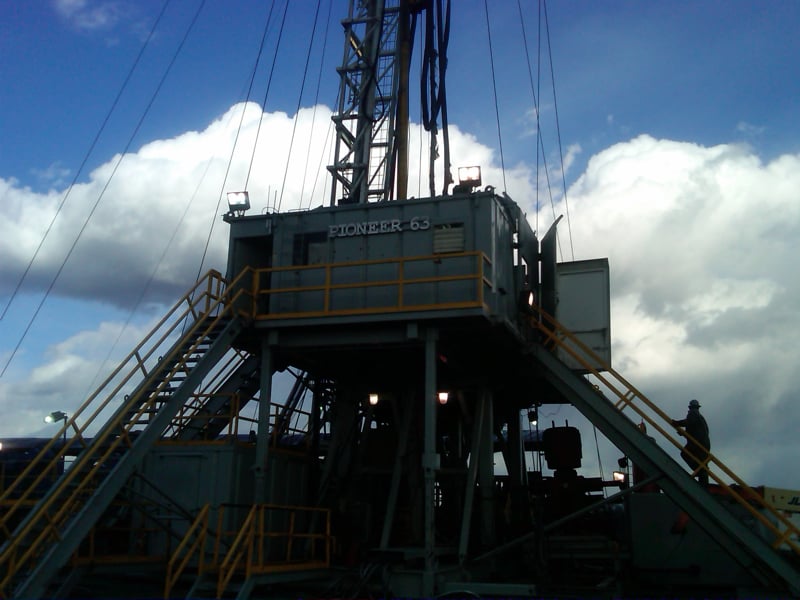

Quantum Energy Partners, which backs oil drilling companies such as HG Energy, has raised its seventh private equity fund at around $5.8 billion. Quantum is a Houston-based energy-focused private equity firm. The firm was founded in 1998 by S. Wil VanLoh Jr. and Toby Neugebauer. Neugebauer and VanLoh are former investment bankers at Kidder, Peabody & Co. The two co-founded energy-focused investment bank Windrock Capital. Neugebauer's father is Randy Neugebauer,(R-Texas), a former member of the U.S. House of Representatives. “The energy sector remains an attractive place for private capital to play an outsized role," says Quantum president Dheeraj Verma. "As the energy landscape continues to evolve globally, it is presenting us with many opportunities to create entrepreneurially driven businesses that can create jobs and value in a safe and responsible manner. We are excited about the next decade of energy growth and activity, particularly as North America will play a larger role in providing the world with low-cost and responsible energy." Some of Quantum's other investments include Ceritas Energy, Crump Energy Partners, EnergyQuest and Intensity Midstream.

Quantum Energy Partners, which backs oil drilling companies such as HG Energy, has raised its seventh private equity fund at around $5.8 billion. Quantum is a Houston-based energy-focused private equity firm. The firm was founded in 1998 by S. Wil VanLoh Jr. and Toby Neugebauer. Neugebauer and VanLoh are former investment bankers at Kidder, Peabody & Co. The two co-founded energy-focused investment bank Windrock Capital. Neugebauer's father is Randy Neugebauer,(R-Texas), a former member of the U.S. House of Representatives. “The energy sector remains an attractive place for private capital to play an outsized role," says Quantum president Dheeraj Verma. "As the energy landscape continues to evolve globally, it is presenting us with many opportunities to create entrepreneurially driven businesses that can create jobs and value in a safe and responsible manner. We are excited about the next decade of energy growth and activity, particularly as North America will play a larger role in providing the world with low-cost and responsible energy." Some of Quantum's other investments include Ceritas Energy, Crump Energy Partners, EnergyQuest and Intensity Midstream.

For the moment, Elon Musk is struggling to overcome his doubters. Less than 24 hours after stunning Wall Street by tweeting that he might take Tesla Inc. (Nasdaq: TSLA) private, six of the company’s directors confirmed that he’d indeed raised the possibility with the board. Musk owns an almost 20 percent stake in Tesla, meaning he’d still need roughly $70 billion in financing to take Tesla private. That kind of money may be accessible through sovereign wealth funds or other strategic investors, said Dwight Scott, president of Blackstone Group LP’s (NYSE: BX) GSO Capital Partners. Musk’s money-losing and cash-burning company is an unlikely candidate for debt investors to be willing to help go private, reports Bloomberg News. Many questions remain unanswered, including the big one: how would Tesla come up with the money to pull off a deal valuing the unprofitable company at more than $80 billion? Read the full story: Tesla board weighs Musk's go-private gambit doubted by the market.

Deal News

Boston Scientific Corp. (NYSE: BSX) is buying the 75 percent stake it does not already own in medical device company Veniti Inc. for up to $160 million. Veniti makes devices that are used to treat venous obstructive diseases, which are instances of abnormal, blocked or damaged veins.

Building products company GMS Inc. (NYSE: GMS) has acquired construction materials distributor Charles G. Hardy Inc. The target offers products that are used to produce drywall, steel studs, ceilings, insulation and commercial doors.

Golden Gate Capital has bought a majority stake in Aperio Group, a research-based investment management firm. Aperio designs and manages customized public equity portfolio services in separately managed accounts to meet the goals of advisors and their clients. UBS Investment Bank advised Aperio.

Lincoln Road has acquired Pro-Tec Fire & Safety, a provider of fire extinguisher and safety services in the Southeast. Holland & Knight LLP represented Lincoln Road.

Tower Arch Capital has invested in Panaoramic Doors, a maker of panel folding patio doors. Choate Hall & Steward LLP advised Tower Arch.

Vista Equity is buying Alegeus from Lightyear Capital. Alegeus helps consumers manage their healthcare spending accounts including FSAs, HSAs, HRAs, and also offers debit cards. Bank of America Merrill Lynch, TripleTree and Simpson Thacher & Bartlett are advising Alegeus. Kirkland & Ellis is advising Vista.

N.B.C. Bancshares in Pawhuska, in Oklahoma, has agreed to buy Bank of Cushing in Oklahoma. The combined company would have more than $300 million in assets, both banks announced in a press release on Tuesday. Current Bank of Cushing President John Bryant and Brenda Magdeburg, executive vice president, will continue in leadership roles once the deal closes. The $209 million-asset N.B.C., which is the holding company of Blue Sky Bank, currently has four branches, including two in Tulsa, Okla. Bank of Cushing has assets of $102 million and two branches. Read the full story: Oklahoma bank widening reach with acquisition.

Fetaured Content

Exponent, a new group of women dealmakers, brought together 200 women from private equity funds, investment banks, entrepreneurs and advisors for the Exponent Exchange, featuring Sallie Krawcheck as the keynote speaker. Previously the CEO of Wall Streetbanks, including Merrill Lynch Wealth Management and Citi Private Bank, Krawcheck serves as the CEO of Ellevest, an online investing platform for women. Mergers & Acquisitions participated in the event as an in-kind sponsor, and editor-in-chief Mary Kathleen Flynn moderated Spotlight Panel, From Startups to Showtime: Investment Case Studies. Check out our slideshow, Exponent drew 200 women dealmakers to event featuring Sallie Krawcheck.

Mergers & Acquisitions has announced the Rising Stars of Private Equity. These 11 up-and-coming investors are expected to play significant leadership roles in the future. Congratulations to:

Daniel Hopkin, Partner, Kainos Capital

John Kos, Principal, GTCR

Erik Latterell, Director, Stone Arch Capital

Ethan Liebermann, Principal, TA Associates

Jaime McKenzie, Director, Monomoy Capital

Jennifer Roach, Vice President, Yellow Wood Partners

Joseph Rondinelli, Principal, Frontenac

David Shainberg, Vice President, Balmoral

Tom Smithburg, Vice President, Shore Capital Partners

Nicholas Stone, Managing Director, Cyprium Partners

Afaf Ibraheem Warren, Senior Associate, Siris Capital

For profiles of the emerging leaders, see Meet Mergers & Acquisitions' 11 Rising Stars of Private Equity.

Summer reading list: From stories of star athletes Arnold Palmer, Keith Hernandez and Tiger Woods to advice from entrepreneurs Bridgewater Associates’ Ray Dalio, KPCB’s John Doerr, Nike’s Phil Knight and Brava Investments’ Nathalie Molina Niño, plus strategies to help business leaders in general, and female dealmakers in particular, the 15 books on Mergers & Acquisitions’ list entertain, instruct and inspire. Check out our listicle: Dealmaker’s guide to summer reading: 15 new books.

After clicking on a story, use the back arrow in your browser to return to your search results. Use phrases "in quotes" or the tools below to better filter your results.