P&G and Tyson Foods are focusing on growing their top brands while seeking acquisitions. Nike is expanding its digital efforts, while Best Buy is looking to cater more to the growing group of senior shoppers. Here are 8 strategic buyers and their acquisition strategies.

Best Buy adds emergency services for aging population

Tech retailer Best Buy Co. (NYSE: BBY) is buying GreatCall, a provider of emergency response services for seniors, from GTCR for $800 million. Under the Jitterbug and Lively Label brands, GreatCall makes wearable devices that connect to services with trained agents who answer questions, dispatch emergency personnel and reach family caregivers. The acquisition is part of Best Buy's strategy to expand its products and services for the senior population. Best Buy estimates that there are over 50 million Americans over the age of 65, and the company expects the number to increase by at least 50 percent within the next 20 years.

Energizer expands auto care business

Battery maker Energizer Holdings Inc. (NYSE: ENR) has agreed to buy the Nu Finish Car Polish and Nu Finish Scratch Doctor auto care brands from consumer products company Reed-Union. "Adding the strength of the Nu Finish and Scratch Doctor brands to our existing Lexol and Eagle One products expands our auto appearance portfolio and continues our strategy of building our auto care business, both organically and through acquisitions," says Energizer CEO Alan Hoskins. In addition to its Energizer battery brand, Energizer has an auto care division that consists of car fresheners and polishes that includes the brands: Refresh Your Car!, California Scents, Driven, Bahama & Co., Lexol and Eagle One.

Fortune Brands goes beyond wood for decks

Master Lock owner Fortune Brands Home & Security Inc. (NYSE: FBHS) is acquiring deck materials maker Fiberon LLC for $470 million. The deal expands Fortune's presence in the $2.5 billion deck category. According to Fortune, decks are a critical growing segment of the outdoor sector with a rising need for non-wood materials, which is where Fiberon focuses the majority of its business.

Hershey adds cheese puffs to candy and popcorn

The Hershey Co. (NYSE: HSY) is diversifying its product lines beyond chocolate to appeal to consumers who want healthier snacks. The company is paying $420 million for the Pirate's Booty, Smart Puffs and the Original Tings brands. In 2018, Hershey bought SkinnyPop popcorn owner Amplify for $1.6 billion.

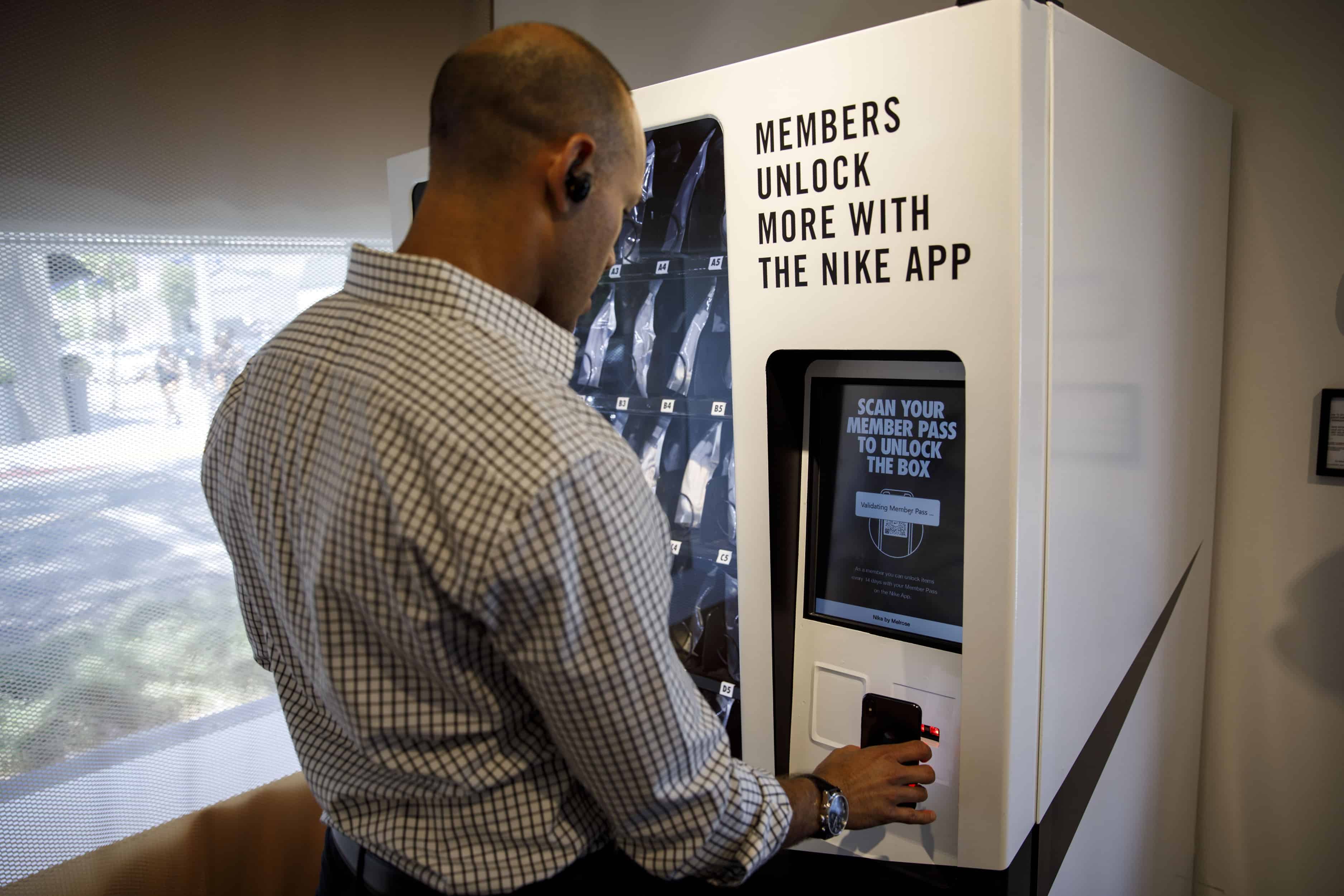

Nike leverages data analytics to discover what customers want

Nike Inc. (NYSE: NKE) is bolstering its digital and tech capabilities through acquisitions to gain more insights to how its customers shop and what they need. Nike bought Invertex Ltd., which uses 3-D technology and mobile applications to analyze consumer buying behavior. The company also purchased consumer data analytics firm Zodiac Inc. Nike remains cutting-edge in its marketing strategies, recently launching an ad campaign featuring NFL player-turned-activist Colin Kaepernick, the star quarterback known for launching the movement to protest police brutality and racial injustice by kneeling during the National Anthem. Nike Sales grew 31 percent during Labor Day weekend when the TV ads first aired, according to Edison Trends.

P&G focuses on brands consumers prefer

Procter & Gamble Co. (NYSE: PG) will focus on growing its top 25 brands including Bounty paper towels, Charmin toilet paper, Crest toothpaste, Pampers diapers, Nyquil cough cold medicine, and Tide laundry detergent, while seeking acquisitions. In April, P&G announced plans to buy Merck KGaA’s consumer-health business for $4.2 billion. The deal includes the Femibion and Neurobion over-the-counter healthcare brands. “What you have to have is the brand consumers prefer, because then retailers want to carry it, because it builds the basket,” noted P&G CEO David Taylor.

Stanley Black & Decker adds tractors and snow blowers

Stanley Black & Decker Inc. (Stanley Black & Decker Inc. (NYSE: SWK), the owner of the Black & Decker brand, is making acquisitions to expand beyond handheld tools. The company is buying a 20 percent stake in MTD Products, a manufacturer of lawn tractors and snow throwers for $234 million. The company is also buying International Equipment Solutions Attachments Group, a maker of heavy equipment attachment tools for off-highway applications for $690 million.

Tyson hopes to feed the world

Tyson Foods Inc. (NYSE: TSN), which bought Hillshire Farm in 2014, is focusing on its core protein business through M&A. The company has agreed to buy protein supplier Keystone Foods for $2.16 billion. Keystone supplies chicken, beef, fish and pork to some of the world’s leading quick-service restaurant chains, as well as retail and convenience store channels. Its value-added product portfolio includes chicken nuggets, wings and tenders; beef patties; and breaded fish fillets. Tyson is also buying the poultry rendering and blending assets of American Proteins Inc. and Ampro Products Inc. for $850 million.